February 2020 — By John Mathis

In 2020, our clients are expecting more from their Corporate Development initiatives, driven, we believe, by two primary factors: 1) a sense of urgency placing greater emphasis on buying over building; and 2) intensifying competition for acquisition targets.

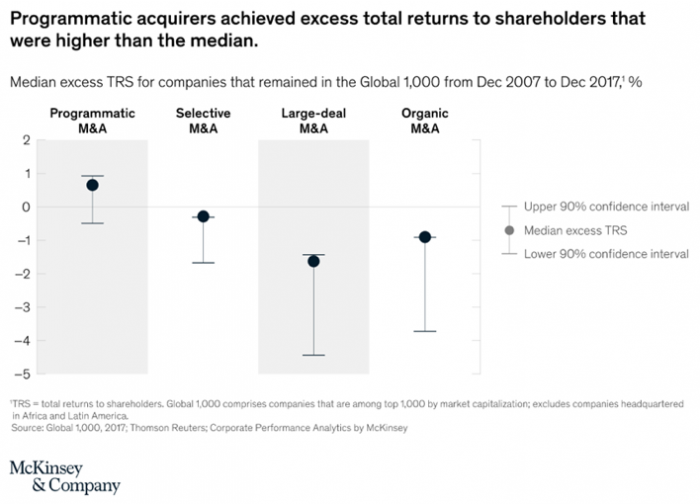

1. Sense of Urgency: Buying vs Building - The sentiment seems focused on now the 11th year of the US macro expansion, driven by the lack of time remaining to invest in building coupled with the improving relative return of acquisitions. This was captured by a recent McKinsey study demonstrating the value of instituting "programmatic acquisition programs". Specifically, the study cites higher shareholder returns when a company conducts a more systematic approach to acquisitions. In the graphic below, we highlight the McKinsey view and the success we have had cultivating what we coined our client's "M&A Brand" through a systematic approach to growth through acquisition programs.

Time ? Buying can be quicker. A CB Insight survey noted new products can take 2 years or more from "ideation" to market. In their analysis, high-performing companies are looking more and more toward acquisitions to drive growth and innovation.

2. Heightened Competition for Acquisitions - The war for acquisitions is on. New entrants and incumbents are all trying to break through to owners and shareholders. For perspective, our sell-side clients tell us they receive an average of 1-2 inbounds a day from private equity, bankers, and companies directly. Adding to the pressure are new sources of capital with hungry appetites and unique funding strategies, including:

What are these trends telling us?

From our vantage point in the middle market for technology enabled firms, the opportunity is clear - get busy acquiring. McKinsey is telling you to be systematic about your approach. Our clients are responding, and below we've summarized our lessons learned from helping our clients launch corporate development programs.

Seven Key Considerations in a Corporate Development Initiative:

1. Lead with Strategy from the top - It is easy to say "start" by systematically identifying priority areas, but how exactly? The starting point is often a goal of growth, innovation, industry leadership, whatever the C-suite and Board have determined to drive competitiveness. We often start with a waterfall - if you want to achieve 15% annual growth, and organic contributes 7%, new initiatives add another 3%, you are left with finding 5% from acquisitions.

2. Factor in a perspective from the trenches – A straightforward next step is to work the leadership and business unit or product leads through a SWOT analysis. We uncover the gaps, set a context for the product or service needs, and include a view on the competitive and adjacent market dynamics. That's a lot to fold into one perspective but the inputs all matter to varying degrees and help set the acquisition course.

3. Get everyone to see the Customer's journey - This is the big obvious one, which for whatever reason, often gets underappreciated. We ask three simple questions:

4. Competitive dynamics - Change and disruption across the competitive landscape can be swift and often unforeseen. One industry leader at a CB Insights conference offered a keen perspective: snow melts from the edges. This analogy encourages us to stay attuned to the field resources closest to customers and competitors, as this is where you first identify threat signals. To understand emerging threats and opportunities, find ways to get out to the edges of the organization where small changes are happening and potentially signaling larger moves.

5. The Corp Dev process should drive an insight loop - We've seen firsthand how a corporate development initiative can generate a flow of fresh market intelligence and feed the strategic thinking of the leadership. It takes a systematic outreach effort to create the flow of information, particularly about private competitors, where they've traded or received funding and where they are headed.

6. If you can't buy, invest - A less capital-intensive approach to innovation that our corporate clients are pursing is to establish a Corporate Venture Group ("CVG"). Taking a page from both the larger firms (e.g. Salesforce.com has funded an ecosystem of nearly 400 companies in 10 years) and the VC world, we've helped our clients launch funds designed to make smaller, earlier stage investments. This approach adds diversity to the innovation investment mix. The market has matured with easy to use investment structures such as SAFE ("simple agreement for future equity") notes that postpone the tough valuation assessment until the company is more fully formed.

7. Technology tools in the Corp Dev process - We've seen more enterprise sized organizations looking to leverage technology across the corporate development process: from workflow based virtual data rooms to great investment in the execution of integration and change management with young firms like LiiRN (see https://www.liirn.com/), providing "people-powered transformation."

Please reach out if we can be helpful when you are ready to mobilize your corporate development resources and get busy growing through acquisition. Contact Harbor View.

DISCLAIMER This presentation is intended for information and discussion purposes only and does not constitute legal or professional investment advice. Statements of fact and opinions expressed are those of the participants individually and, unless expressly stated to the contrary, are not the opinion or position of Harbor View Advisors, LLC (“HVA”). The information in this presentation was compiled from sources believed to be reliable for informational purposes only. HVA does not endorse or approve, and assumes no responsibility for, the content, accuracy or completeness of the information presented.