The M&A outlook for 2019 is all about the finish line. Looking out across our client engagements and industry resources, the drumbeat of M&A activity continues. However, there is a new emerging factor that was not there a year ago. A small, but nagging sense of urgency to get to market, to get through diligence or to consider alternatives if, dare we suggest it, the market window begins to creak close after a decade long run. So, we present a quick recap of the year and some observations about that expected finish line.

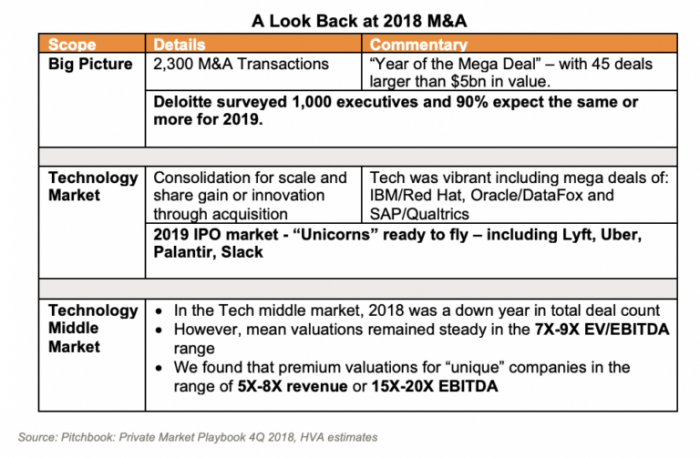

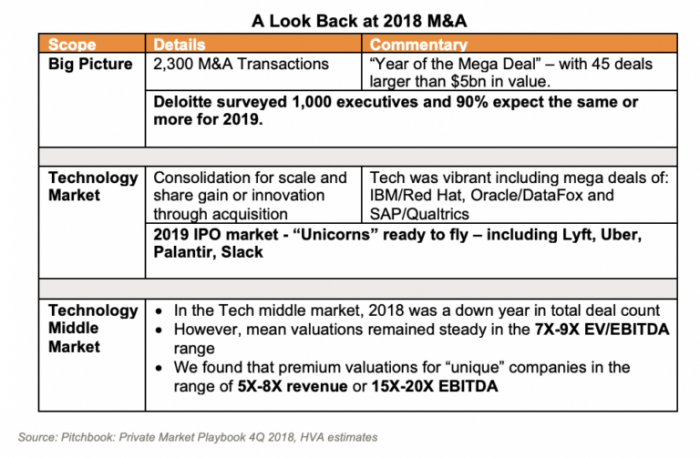

2018 was a busy year in M&A and particularly in the technology sectors. Several “mega deals” greater than $5 billion in enterprise value dominated the headlines across all sectors and particularly in technology with deals by IBM, Oracle and SAP. In the lower middle market for technology we saw strong deal count and total value, again dominated by one or two larger transactions. Valuations remain steady in the 7X-9X EBITDA range for transactions under $100 million in enterprise value. Looking ahead for 2019, more large headline deals as “unicorns” may come to market including Lyft, Uber and Slack. Corporate Development sentiment remains strong, with the majority of deal leaders expecting the same or more in 2019.

Now What? – Expect This Year To Be Active with a Heightened Sense of Urgency.

From three key points of view, we see heightened activity in 2019. First, we look at technology companies and private equity firms as they compete for acquisitions. Second, we highlight trends from our niche markets: Human Capital Management, Financial Technology and Software. Third, we wrap up with summarizing industry observations from leading industry predictors.

I. Technology Companies and Private Equity Firms Compete for Acquisitions

For 2019, we see the market participants continuing to pursue deals with new methods and new entrants. The public company clients and corporations we follow note their capital priority remains stock repurchase or acquisitions. We expect a slight sentiment change as risk tolerance may be waning which would lead strategic acquirers to focus more on consolidation rather than transformative acquisition. On the Financial acquirer front, we see our Private Equity clients very active in add-on acquisition programs. After years of boom fund raising, some commentary suggests a slowing.

The single biggest new trend in Corporate Development at our clients is the launch of Corporate Venture Group (CVG) initiatives. Think of these as internal innovation funds looking to invest in or acquire growth through earlier stage companies. By one count, there are over 1,300 of these funds in the US, up from just 50 a few years ago. More than half of these funds are with technology companies.

In the private equity world, we continue to see active add-on investing to existing platforms. We see financial firms getting more creative in sourcing. For example, a recent client retained our team to begin a sourcing effort before the client closed on its platform investment.

- Company Corp Dev

- M&A vs Share Buyback

- Consolidation

- Corporate Venture Group

- Private Equity

- Add-on vs Platform

- PE funding slows

- Family offices competition

II. Niche Market Commentary: Active Technology Trends Will Continue to Drive M&A

At Harbor View, our focus is on two technology enabled markets: Human Capital Management (HCM) and Financial Technology (FinTech). The people and the money, which represent roughly 90%+ of all private employment and technology spending.

Human Capital Management

Talent Acquisition and Staffing 2019 Outlook: A Top Priority

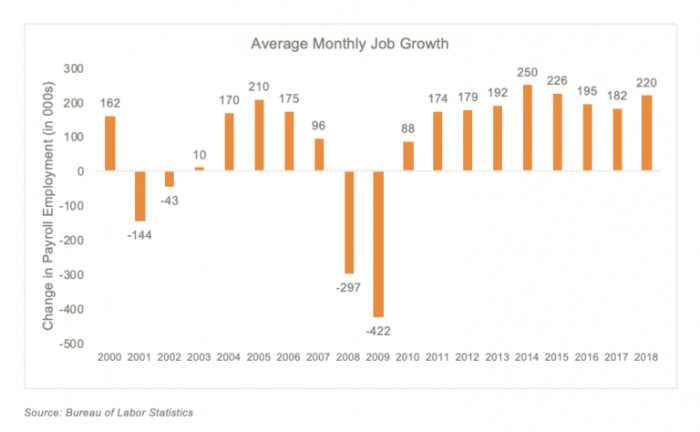

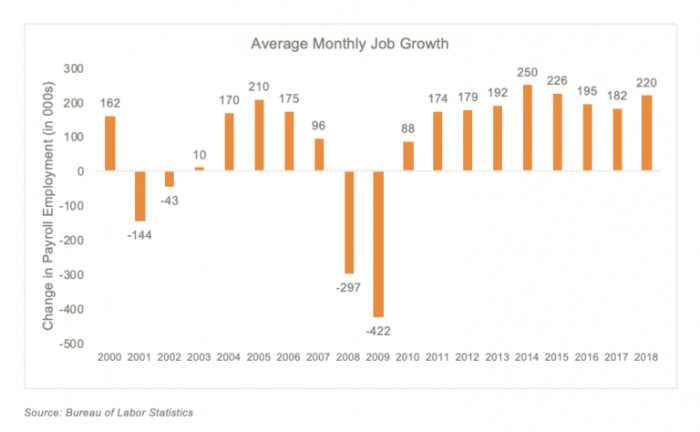

- It’s all about jobs, and growth remains strong: December’s job growth was strong, and 2018 job creation ended at an average monthly job growth of 220,000, outpacing both 2016 and 2017 (see chart below):

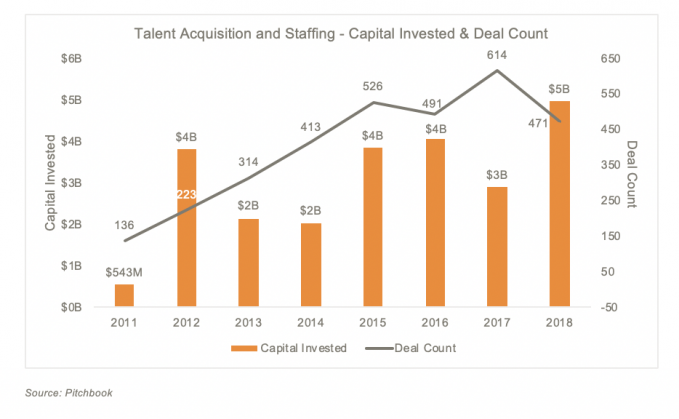

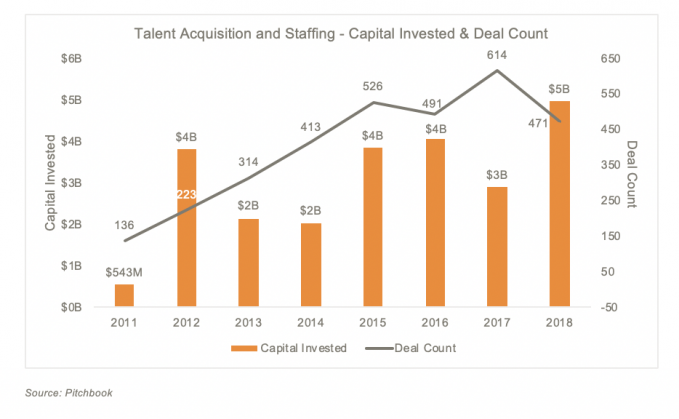

- Our research, including an industry round table earlier this year, highlighted the increased importance of talent acquisition solutions. Industry funding reinforced this with $5bn of investment in 2018: the strongest year ever (see table below). Two mega transactions accounted for half the market when OMERS Private Equity acquired Alexander Mann (tech-enabled recruiting, staffing and human resource services firm) for $1.1bn and Recruit Holdings acquired Glassdoor (online job searching platform) for $1.2bn.

- For 2019, the key trends to watch in Talent Acquisition and Staffing are outlined below along with a representative transaction example:

- Candidate Sourcing– A strong network of past employees and screened candidates for future hiring needs (e.g., Learning Technology Group’s acquisition of PeopleFluent for $150mm)

- War for Talent Continues– A broader approach to building a candidate pipeline (e.g., iCIMS’ acquisition of TextRecruit for an undisclosed amount)

- Analytics Applied to Candidates– Assessments for job qualification and cultural fit (e.g., Exponent Private Equity’s acquisition of SHL Group for $400mm)

Leadership Development 2019 Outlook: Coaching going Digital

Technology could transform every employee into a Leader. No one important has uttered this quote yet, however, someone may, very soon. An important area within Human Capital Management (HCM) is Leadership Development. Enterprises are expressly focused on identifying and grooming future leaders. The academic and practical worlds are intensely focused on developing the tools, content and delivery channels to better optimize the leadership journey for employees. And Technology the enabler.

Coaching in a Digital World: Currently, AI can respond to leaders and “teach” leaders by providing answers through text, articles or videos. Further advancements will enable AI coaches to create plans, set and reinforce goals like a human coach.

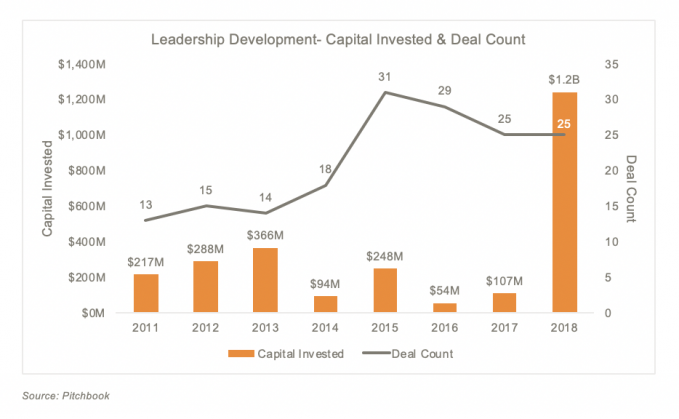

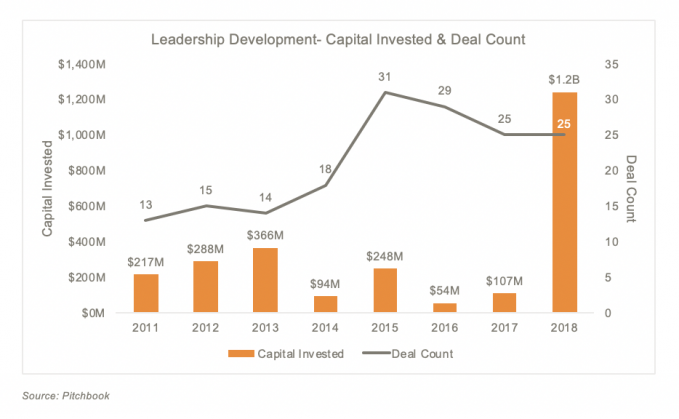

Two mega-deals were the story in 2018, combining for more than $1bn in transaction value (see chart below):

- Vistage Worldwide acquired by Providence Equity Partners in February for $653M

- OnCourse Learning acquired by Bertelsmann in November for $500M

These transactions incorporate the key themes of establishing a coaching culture and digitizing learning content. Industry trends, and our client work has helped us identify three themes for 2019: 1) Digital Transformation; 2) Artificial Intelligence; and 3) Enhanced Coaching.

- Digital Transformation – As the enterprise evolves into more distributed and collaborative structures, the workforce and leadership skills need to adapt. In a global survey of business practices by MIT & Deloitte, employees captured the situation adeptly. Only 34% are satisfied with how their organization is helping them adapt to the digital world and 90% expressed interest in data analytics, tools and AI to help them improve. The transaction activity is consistent with these forces. Roughly 1/3 of the 25 Leadership Development transactions in 2018 involved Digital elements from EdTech, Mobile and other HR Technologies. As a harbinger of skills to come, the higher education EdTech space continues it move towards digital with online course libraries, virtual schooling and online tutoring – preparing future workers for a more digital workspace.

- Artificial Intelligence – As with other sectors, the application of AI is pervasive in HCM. It is enhancing mobile coaching tools with natural language responsiveness. AI is helping to personalize and curate learning content and improve the ROI of development and engagement efforts.

- Mentoring and Coaching Culture – Nearly 2/3rds of companies say they have high potential leadership programs and 68% say they are not effective (DDI). The coaching industry has an opportunity to rise to this challenge through more distributed networks and mobile tools for interaction and content delivery. Broad-based platforms are expanding the scope of leadership development from the high cost of one on one executive coaching to the frontline managers and future leaders driving retention and engagement. For example, BetterUp raised $26 million for its mobile platform that matches coaches, facilitates virtual interaction and tracks new behaviors and skills.

Financial Technology

MortageTech – Tough Headwinds, but with a Sense of Opportunity

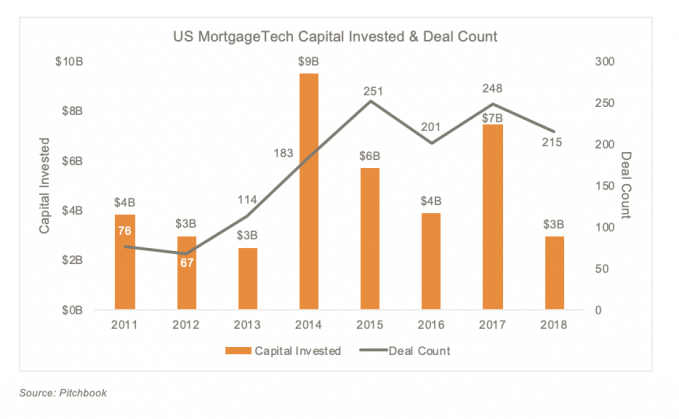

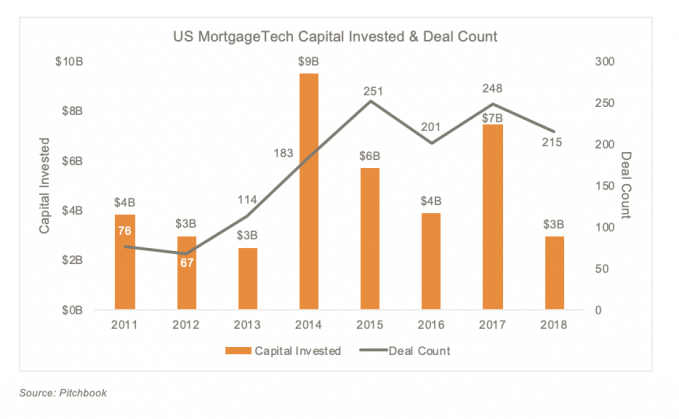

We would characterize 2018 as a modest year for MortgageTech M&A. For the past 10 years, the sector has driven $3-$4 billion in transactions with occasional “mega-deals” (BlackKnight spinout in 2014 and Misys in 2017). Although annual deal count has doubled in the past few years, in 2018 deal count declined about 15%. Industry commentary focused on fewer “quality” companies coming to market and somewhat elevated valuation expectations.

A key macro-economic driver is the housing market and the outlook for mortgage loan originations is often a harbinger for the broader FinTech market. The forecast for 2019 is not dreadful (down 1% from 2018) and after two years of declines, there is some expectation of recovery in 2020.

Historically low mortgage rates climbed in 2018, and consensus expects that to continue into 2019, leading to a drop in refinancing volume. The average rate on a 30-year home loan was ~4.50% at the start of 2019 according to Freddie Mac, up from 3.95% a year earlier. Realtor.com and Redfin forecast the rate on a 30-year, fixed-rate mortgage rising to 5.50% by the end of 2019 and Zillow predicts the rate to reach 5.80% – which would be the highest since the recession a decade ago. Fannie Mae’s December outlook highlights the muted outlook for 2019.

Although this year may bring a tough fundamental market, companies and investors should see M&A opportunities and continue to invest in technology to increase efficiencies and drive down costs. For 2019, three key trends to watch in MortgageTech include:

- Automation– the MortgageTech world is undergoing a transformation of automation enabled by technology in the form of AI, Blockchain and Machine Learning. The buzz around digital mortgages will continue to gain momentum. A headline transaction was Roostify’s $25 million Series B on an estimated $75million post-money valuation.

- Consolidation– we expect key players to roll-up along each value chain to build scale such as the pending Fidelity National Financial (NYSE: FNF) acquisition of Stewart Information Services (NYSE: STC) for $1.2 billion, or roughly 12X 2018e EBITDA.

- Integration– when market volumes are cyclically down, we’ve seen acquirers look to integrate horizontally (into adjacent markets to help balance out financial performance. For example, this past year witnessed traditional real estate platforms entering the mortgage loan market to streamline the home buying process. For example, Zillow’s acquisition of online lender, Mortgage Lenders of America for $65 million. An estimated 3X 2018 revenue.

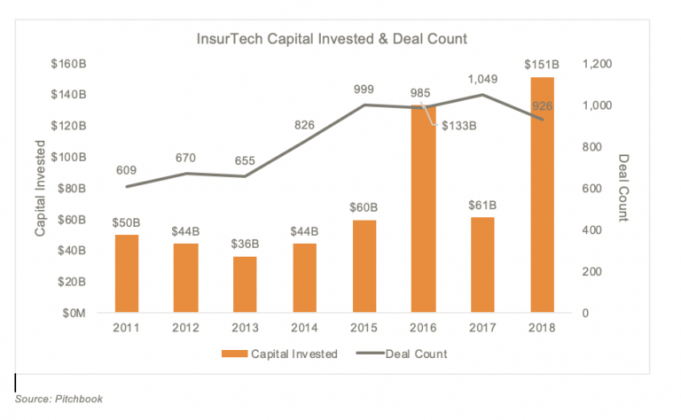

InsureTech 2019 Outlook – Very Busy

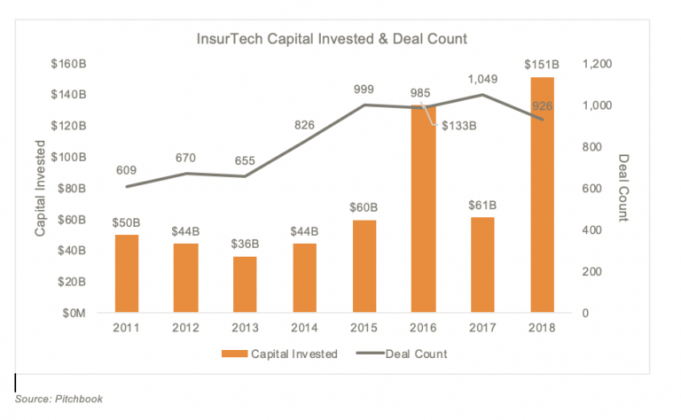

Insurance Technology (“InsureTech”) is an interesting market that generally doesn’t receive a lot of headline attention. However, given the often-manual nature of the insurance process (from customer acquisition to policy writing to claim management) the transaction activity has focused on automation. We see three trends in 2019 that should continue to shape the InsureTech landscape: 1) Automation; 2) Big Data Analytics; and 3) Machine learning.

- Automation: The largest insurance carriers continue to invest in their technology stacks and cloud computing is enabling greater automation.

- “The traditional drivers of cloud computing—cost savings and pay-as-you-consume contracts—will likely continue to push usage. Yet the next round of adoption will likely be driven by other key benefits that cloud offers—namely speed, flexibility, and scalability.” (Deloitte 2019 Insurance Outlook)

- Expect legacy system replacement with cloud first alternatives to accelerate for new applications and workloads. We would expect M&A to pick up as key stakeholders look to differentiate already proven technology rather than develop internally.

- Notable transactions include:

- CoreLogic a provider of property information, analytics and data-enabled services acquired Symbility Solutions a cloud-based insurance claims company.

- Majesco a provider of cloud insurance technology acquired Exaxe a cloud-based insurance technology provider for $14M.

- Big Data Analytics: Moving into 2019 we expect to see insurance carriers leverage big data and analytics to improve the underwriting and claims process.

- Utilizing big data in the underwriting process can increase profitability and efficiency. Sensor technology is a contributor to the big data evolution that is changing the insurance industry. Sensor technology has increased dynamic pricing and increased transparency in insurance claims settlement.

- Notable transactions include:

- Verisk Analytics a data analytics provider has entered into a definitive agreement to acquire Rulebook in an $87 million all-cash deal which is set to close Q1 2019. Rulebook is a business intelligence and software solutions provider serving primarily the London market.

- Indio Technologies raised $6 million in Series A funding led by 8VC putting the Company’s pre-money valuation at $15 million. Indio’s platform offers centralized workflow management services to access quotes from multiple carriers and helps in processing insurance applications from clients.

- Adoption of Machine Learning/AI/Blockchain: In 2018 there was a heightened focus on cybersecurity which we expect to permeate into 2019. A

- Insurance providers will continue to tackle cybersecurity throughout 2019. We expect to see carriers leverage blockchain technology to mitigate risks and manage cyber liability exposure.

- Blockchain can offer improvements to the insurance process from underwriting to reinsurance by detecting fraud, improved risk prevention, increase transparency contributing to claim prevention.

- Notable transaction:

- Zesty.ai raised $13 million in a round of Series A angel funding. Zesty. Ai developed a proprietary risk analytics platform which provides integrated property, place and people data providing insurance providers with a holistic data set. The platform utilizes deep learning and digital imaging so that insurance and real estate companies may avoid inaccuracies, fraud and onsite inspections.

Software

The overall software market continues its ascent and if we focus on the fastest growing area, SaaS, we see a market growing nearly 20% annually and expected to reach $85bn in 2019 (Gartner). A review of the commentary from public Software/SaaS companies, our clients and third-party research highlights three keys for 2019:

- Consolidating gains. 2019 seems to be the year for brand investment following years of market development and customer traction gains. The early stage SaaS axiom of each company having close to 10 competitors suggests that there will come a time for the stronger to absorb the weak, perhaps it will be this year.

- Data. The torrent of data will continue and perhaps 2019 will be the year that technology tools begin to catch up with practical applications to unceasing enterprise problems. Two key areas of promise are customer prospect identification and the never-ending pursuit of automation. The software/SaaS leaders see a “product-led” trend where massive amounts of data on product usage will help to prioritize opportunities and new tools will pick up the pace – think Slack, Atlassian, Dropbox and Expensify (see Openviewpartners.com).

- Channels. The pursuit of unique go-to-market strategies will continue (consistent with early stage and overlapping competitive markets). Where the next evolution of CRM(Customer Relationship Management) could become PRM for Partner Relationship Management. Leading companies are striving for that 40% annual growth threshold and partnering is seen as one way to amplify growth. Examples include Think Box, AppCues and Proov (according to AchieveUnite).

III. A Summary of Leading Sources and Their Predictions for the Technology World in 2019

A cross section of sources suggests current trends will continue, fueled by corporate and private equity “dry powder” and the promise of new innovative areas of technology including AI, cloud and big data analytics.

DISCLAIMER This presentation is intended for information and discussion purposes only and does not constitute legal or professional investment advice. Statements of fact and opinions expressed are those of the participants individually and, unless expressly stated to the contrary, are not the opinion or position of Harbor View Advisors, LLC (“HVA”). The information in this presentation was compiled from sources believed to be reliable for informational purposes only. HVA does not endorse or approve, and assumes no responsibility for, the content, accuracy or completeness of the information presented.