We coined a term to describe the current dynamics in the M&A market surrounding our clients in the technology and services arenas – “Scalidation” – a mash-up of Scaling through Consolidation. While M&A activity is down, we are seeing a few brave acquirers move opportunistically to roll up for scale.

S&P reports US M&A activity fell by nearly 40% in Q2 of 2023* as buyers retrenched to find more straightforward roll-up acquisitions of good quality cooperative sellers. The Middle Market (~$100-500M EV) suffered similar pressure and technology even more so.

The typical pattern for M&A is to retrench at the beginning of a downturn as deal models reset to new risk and performance expectations. However, we sense a heightened level of opportunistic aggressiveness in some buyers, eager to get back to the business of M&A.

We see three types of “Scalidation” actors:

- The Savvy: In today’s environment, savvy acquirers seek to gain scale, take out their competition and gain earnings visibility through acquired synergies.

- The Strong: During a typical macro downturn, markets will naturally consolidate – strong getting stronger and consolidating the weak where more moderate valuations capture heightened market risk.

- The Merger Makers: Where a combination of equals brings two sides together, often relying on a stock-based transaction to level out the valuation expectations.

Notably, today’s market forces are driving M&A models to adapt to very challenging conditions:

- Valuation: Perhaps contrary to headline commentary, we’ve seen fairly stable valuations in the second and third quartiles of our markets. The pressure on valuation has been strongest on the ends – the high performers where growth has slowed and lower performers where optimism for recovery has faded. We expect to continue to see smaller transactions and lower price points but often with transaction terms that help bridge to a deal.

- Reduced Easy Access to Credit: Acquirers have had to risk-adjust their deal models for higher financing costs and rising end-market demand uncertainty. The most active are PE-backed portfolio companies focused on rollups that help build scale through market consolidation.

- Cash Is Always King: Importantly, the supply of innovation has been restricted by risk-averse investors, fewer financing sources (e.g. the exit of Silicon Valley Bank) and a glut of early-stage companies running out of cash. The true test of any founder will be how quickly they can focus and turn cash flow-positive all while protecting their team’s equity before having to succumb to a venture recap.

As once said by Warren Buffet "You only find out who is swimming naked when the tide goes out."

The challenges are most acute at the lower end of the private equity-backed middle market:

- Funding: From our conversations with PE groups, since the beginning of this year, fundraising continues to be a challenge except for top-quartile funds who continue to raise. The smaller, newer and with less track-record funds are feeling the pressure.

- Premiums: The exception to current valuation trends cited above are the A+ companies, who continue to receive market-leading multiples, however, anyone less worthy is challenged.

- Small Cannot Get Respect: The smaller transactions and funds are feeling the most pressure as funds have moved up market to larger targets and funds in general have become more cautious in deploying capital for anything more than small tuck-on/add-on sized acquisitions.

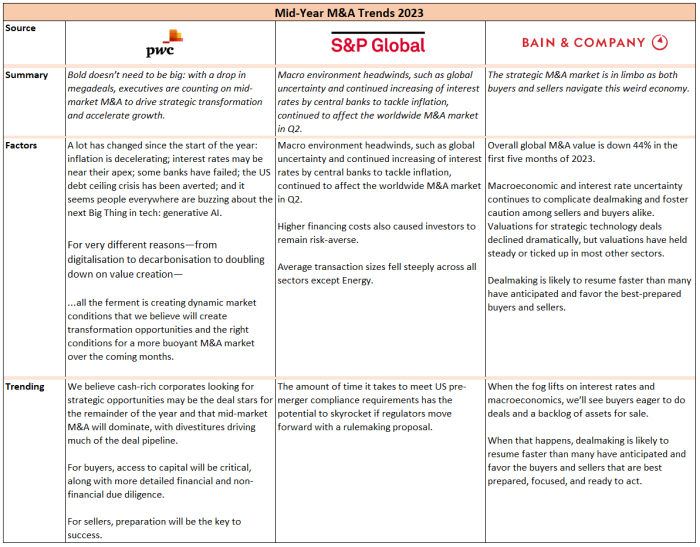

In summary, as we move into the second half of 2023, we reviewed three leading research sources in the M&A markets – S&P, PWC and Bain. A snapshot of their most recent commentary is captured in the table below. The consensus across them points to an expectation that the current “M&A fog” may soon lift, and serious players should be prepared for a rapid return to deal-making.

Sources:

DISCLAIMER This presentation is intended for information and discussion purposes only and does not constitute legal or professional investment advice. Statements of fact and opinions expressed are those of the participants individually and, unless expressly stated to the contrary, are not the opinion or position of Harbor View Advisors, LLC (“HVA”). The information in this presentation was compiled from