August 2019 — By Shatara Troy

M&A and VC Activity Intensifies in 2019

HR tech continues to be a hotbed of M&A and VC activity with 2019 set to outpace an already record-breaking 2018. The key drivers behind this momentum include:

The first half of 2019 clocked in with over $3.2 billion in VC funding alone[1]. This represents a 60% increase over 2018, where we observed $4 billion in VC funding for the entire year. Similarly, on the M&A front, while deal count remains relatively steady when compared to 2018, mega deals like Ultimate Software’s $11 billion go-private acquisition by a private equity group has helped positioned HR tech M&A for another outstanding year[2].

The Hot Spots

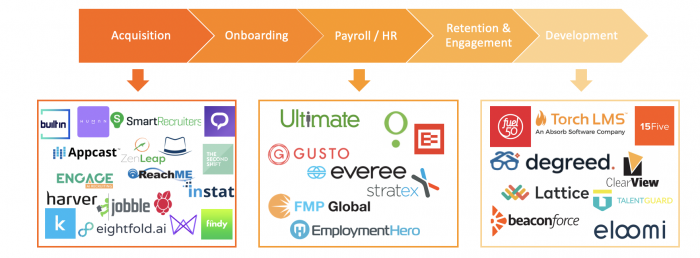

When we review the 175+ transactions so far in 2019, the majority of the investment activity has focused on Talent Acquisition, Payroll and HR administration and Talent Development. In the graphic below we highlight a number of the key transactions announced along the HR Tech spectrum.

Talent Acquisition – Technology That Improves Sourcing

The war for talent continues – unabated since the phrase was coined by a McKinsey consultant in 1997. As the U.S. labor market continues to tighten, employers are becoming more discerning on where to find the right talent, how to leverage existing talent pools and how to best streamline the talent acquisition process.

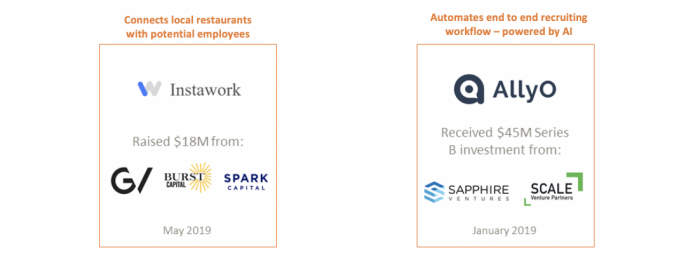

There has been a rise in funding of niche job-posting platforms and networks tailored to specific roles and circumstances. Additionally, investors have focused on AI and workflow platforms geared towards capturing passive candidates and relieving recruiters from time-consuming sourcing activities. Two notable examples are outlined below. Instawork, a startup focused on the gig economy specifically in the hospitality market raised $18 million earlier this year and AllyO raised $45 million from the likes of Google’s AI fund (Gradient Ventures) to help build out its AI-powered job recruitment solution.

Payroll and HR Administration – The Backoffice Jumps Into The Spotlight

Payroll and HR Administration – The Backoffice Jumps Into The Spotlight

Long dominated by the big three (ADP, Paychex and Ceridian) this corner of the HR world shifted when Ultimate grew large and went private and it is shifting again as technology works its way into underperforming niches. We now see a natural movement to market consolidation and late-stage funding among the new generation of tech savvy payroll and HR admin platforms. Additionally, we are seeing industry-specific platforms expand their offering via acquisitions, ultimately creating greater wallet share within their existing addressable market.

Two headline examples include Toast and Gusto. Toast, a “unicorn” sized restaurant technology company acquired a former Harbor View client, Stratex from Halyard Capital. Well on its way, Toast’s reported market value is over $2.5 billion. In another example of niche payroll and benefits, Gusto secured $200 million in “D” round funding from Fidelity in its aspiration to set “…a new industry model for what total compensation can look like for employees at companies of all sizes.”

Talent Development – A Virtuous Loop of Improvement

Talent Development – A Virtuous Loop of Improvement

As the definition of “employee engagement” evolves and expands, talent development is being elevated strategically by employers who recognize its impact on employee retention, performance and engagement. We see VC entrants that redefine traditional talent development with more intuitive review mechanisms. The deals funded suggest a move towards more employee-driven career mapping with employers providing resources and forums to facilitate career goal actualization.

Two notable transactions include Fuel50’s $14 million capital raise from PeakSpan Capital and Betterworks’ raise of $65 million. Fuel50 is a “career experience and talent management platform” that boosts career pathing while Betterworks provides an enterprise-level continuous performance management HR software.

The Full Year Outlook – Elevating the HR Department is a Strategic Imperative

All signs indicate continued acceleration of HR Tech deal activity as favorable employment trends and capital rich investors are likely to continue fueling the momentum. 2019 is poised to be a record-breaking year and we look forward to staying in the thick of it as our clients seek out new and innovative ways to take HR to new heights of strategic importance.

Connect with us at the HR Tech Conference this October to learn more about our industry expertise, insights and HCM deal activity. Contact Us today!

[1]https://larocqueinc.com/q2-2019-global-hr-tech-venture-capital-review/

[2]Pitchbook