February 2022 — By John Mathis

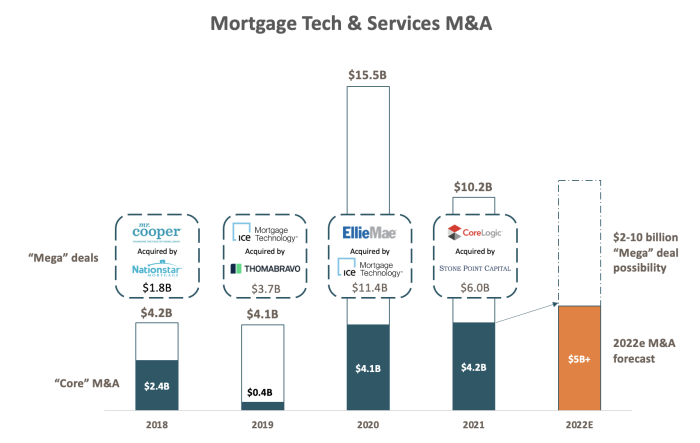

This is very likely to be a tumultuous year in MortgageTech & Services. The past two years were HUGE with over $20 BILLION in transaction value, with M&A driving more than half of the action including two mega-deals – the ICE/Ellie combination in 2020 and CoreLogic/Stone Point go-private in 2021. We’ve already had a $1 billion deal in February, and we expect at least a mega-deal per year as the industry consolidates on the natural scale advantages.

As for the M&A trends this year, our industry checks suggest healthy acquisition appetites fueled by successful PE fundraising and enlarged company cash balances.

As depicted in the chart below, the past two years held a steady $4bn M&A pace (excluding mega deals). The potential for 2022 seems powerful given that leading MortgageTech players have more than $4bn in cash AND private equity funding represents 3-4X more in available funds. Combined with our clients and other industry commentary, we believe 2022 could set a $5bn record M&A pace, which may come as a surprise given the anemic mortgage market outlook.

Industry Conversations - Every year we survey the key players to get a sense of their outlook and M&A priorities for the new year. For 2022, the consensus paints a dramatic picture:

The year is off to a fast start for Harbor View Advisors as we just led the closing of a client exit in the Loan Quality Control space and we expect to be in the market with several sell-side opportunities including:

As well as buy-side client engagements in:

Sources: Pitchbook, Company reports, MBA forecast, HVA estimates

DISCLAIMER This presentation is intended for information and discussion purposes only and does not constitute legal or professional investment advice. Statements of fact and opinions expressed are those of the participants individually and, unless expressly stated to the contrary, are not the opinion or position of Harbor View Advisors, LLC (“HVA”). The information in this presentation was compiled from sources believed to be reliable for informational purposes only. HVA does not endorse or approve, and assumes no responsibility for, the content, accuracy or completeness of the information presented.