April 2021 — By Doug Moffitt

Industry veterans consistently focus on a Wealth Management firm’s ability to generate strong, sustainable organic growth. This particular metric sets the leaders apart.

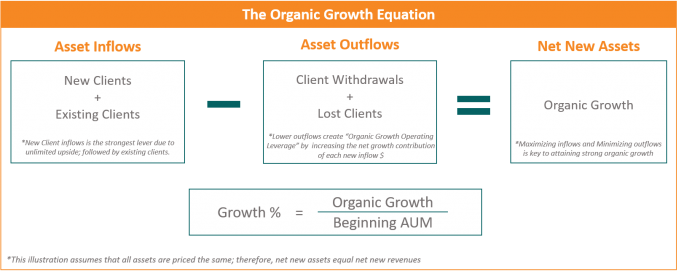

Organic growth represents growth in net new assets (or revenue), independent of changes in market value. Essentially the formula for organic growth is: assets/revenue that come in (inflows) minus assets/revenue that leave (outflows). It is a simple but challenging equation, which becomes increasingly difficult to sustain as the law of large numbers takes hold. While industry thought leaders speak about its importance, few people address how to achieve it.

In this note, we outline successful steps Wealth Management leadership teams can take. The simplicity of the Organic Growth Equation, and each of its Levers, is easy to describe, yet intensely difficult to achieve. In our experience, if an entire firm, from its senior leadership team to the newest employee, understands the importance of the equation and its levers, decisions become clear and each role becomes more relevant.

Wealth Management leaders intuitively understand this equation but may not use it to build a strategic framework or plan of action. They may also misinterpret these metrics when it comes time to evaluate their business. Common mistakes include:

Above $1 Billion in AUM, organic growth often begins to stall. The difficulty comes down to an intersection of math and human behavior:

Eventually, firms begin each year essentially “in the hole” because their clients will spend money (“consumption”) and they will also lose some clients (“attrition”) for various reasons. These are the common “outflows” in the Organic Growth Equation. For example:

A firm’s organic growth may also slow because much of it was built by advisors who are passionate about serving clients, but less intentional about putting the people and business practices in place to ensure that they maintain their growth trajectory. In addition, much of their hiring has centered on maintaining their expanding client base, with less focus on broadening new business capabilities.

To many fiduciaries, “Sales” is a dirty word. But while “Growth” is a good word, implementing an intentional process for generating growth can be uncomfortable. Understandably, fiduciary advisors liken themselves somewhat to doctors with a practice, which grows as a result of providing excellent care and attracting referrals. And while this is true, it is not enough for a firm whose leadership has made the strategic decision to grow. This sets the stage for understandable conflict within firms that want to grow, either to remain independent or become an attractive merger candidate.

Taking a practical approach to organic growth and each of its components is the most effective way to realize sustainable organic growth. For Wealth Management Firms that wish to either remain independent, or prepare for an optimal exit, it is imperative. Organic growth directly impacts a firm’s valuation and attractiveness as an M&A candidate. Finally, for an acquisitive firm, having strong net growth of your own can set you apart as a “Buyer of Choice,” increasing your attractiveness to sellers.

If you’re looking to bolster your organic growth, we recommend these three steps:.

Step 1: Separate each part of the Organic Growth Equation and ask yourself: “are we taking the proper steps with people, processes, technology and incentives to leverage each part?” Choose your answer carefully. Think of it as the mission statement for your leadership team - a guiding compass that will ultimately inform your organic growth strategy.

Step 2: Work your way through key tactical questions; some examples include:

Step 3: Zoom in and examine how even the smallest daily activities can impact organic growth. For example: does your receptionist realize the business impact of knowing how a client takes her coffee upon arriving for an annual meeting? It sounds trivial, but a small act like that can:

In this case, three parts of the Equation have been impacted – all by something as simple as a cup of coffee! By helping employees understand how the second and third order consequences of their simplest actions impact the company’s bottom line, you connect people’s roles to something larger than themselves. This also reinforces a positive culture: it contributes to employee retention, and it builds a sense of an interconnected, firmwide effort.

We know from experience that achieving sustainable organic growth is a forever challenge. We have faced this challenge across several different business models, including within one of the largest trust companies in the United States, a boutique private bank trying to grow its Wealth Management business, and within a large, acquisitive, independent RIA. After dealing with this problem firsthand many times, we have found that defining the Organic Growth Equation and tackling each of its levers can work – just keep at it.

If you have been searching for a way to achieve and understand organic growth in your firm, Harbor View can help. As your Advisor, we can help assist your leadership team at the strategic level or get more granular, and tactically address each component of the Organic Growth Equation. Together we can focus on specific strategies that really move the needle, such as:

If you are an acquirer, our experience allows us to work with you to understand what matters most:

We also understand the “Seller’s Journey,” and can partner with you to prepare your firm; guiding you through the process step-by-step until you reach the optimal outcome.

Our Financial Services practice is led by Doug Moffitt, a Wall Street and Wealth & Asset Management Veteran of more than 35 years. Doug provides industry expertise and has “Walked in Your Shoes”. If you are considering a potential strategic alternative for your company – connect with us at Harbor View. Our investment banking services help companies get the results they deserve, guiding them step-by-step through all stages of a transaction.

DISCLAIMER This presentation is intended for information and discussion purposes only and does not constitute legal or professional investment advice. Statements of fact and opinions expressed are those of the participants individually and, unless expressly stated to the contrary, are not the opinion or position of Harbor View Advisors, LLC (“HVA”). The information in this presentation was compiled from sources believed to be reliable for informational purposes only. HVA does not endorse or approve, and assumes no responsibility for, the content, accuracy or completeness of the information presented.