March 2019 — By Tyler Lamer

Record deal volume. Heated competition. Unexpected buyers, more corporate investors, and an abundance of capital. The M&A space has been in a state of flux for the past few years—and the new normal may very well be constant change. For corporate development teams, opportunities abound, especially for companies relying on acquisitions to spur their own digital transformation or fuel growth and innovation.

But surviving—and thriving—in this era isn’t easy. To compete and win against private equity firms, family offices and other strategic buyers, you can’t simply react to potential deals that come your way. A lack of foresight, disciplined processes, and flexible bandwidth prevents many strategic buyers from acting successfully on great acquisitions.

The best corporate development teams avoid falling behind by setting a solid direction for their program, proactively building their pipeline of targets, and following through with a thoughtful integration plan that sets everyone up for success. As a result, they build an M&A brand that precedes them and creates the possibility of even better deals in the future.

Welcome to 2019: If you’re not early, you’re late

M&A activity is steadily moving upstream, as PE firms and strategic buyers aim to invest in, and acquire, earlier stage companies. For the latter group, this is especially important. Acquiring a new tech solution that addresses one of your own core weaknesses, automates a manual aspect of your business or solves a key customer problem is more efficient than building solutions internally. Bringing that talent in house also ignites the possibility of even more innovation down the road.

What’s in store for the tech middle market? Check out our 2019 outlook

To this end, we’re seeing a lot of the current M&A trends focused on identifying opportunities at a much earlier stage, approaching target companies before they’re “for sale,” and investing in startups that promise to serve the next generation.

Here are three key trends that will impact your corporate development work this year:

Trend #1: Corporate venture investing goes mainstream

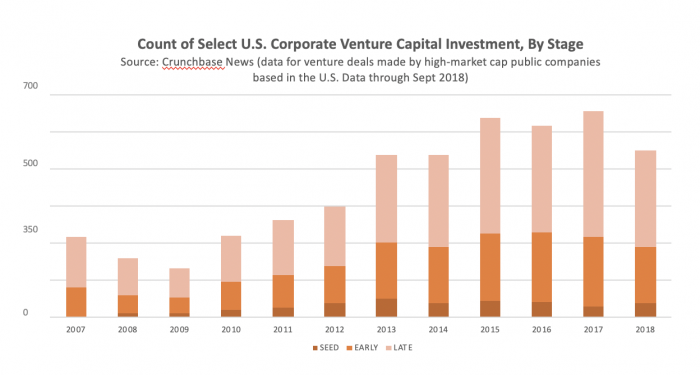

Corporate venture groups have been investing in early stage companies in record amounts. In 2018, the investment arms of companies drove $53 billion into startups, a 47% increase from the previous year. There are, by some counts, more than 1,300 corporate venture groups in existence—up from a few dozen less than a decade ago.

To be sure, industry giants such as Google Ventures, Microsoft Ventures and Cisco Ventures play a big role in the space. But corporate venture groups are also an increasingly attractive way for even mid-sized companies to explore new technologies and cultivate a pipeline of potential acquisitions. Case in point: seed and early stage investments far outpaced later stage investments for CV groups last year.

HubSpot, for instance, launched a $30 million fund last December, with the intention of funding companies that deliver additional value to their “customer community.” In fact, 186 corporate venture funds made first-time investments in 2018. From what we see, this wave of corporate investing will likely continue. Acquisitions can solve nearer-term issues, such as fill a technology gap or bring in a much-wanted customer, for mid-sized companies. But corporate venture gives organizations looking at their long-term viability another way to cultivate resources and increase their competitiveness.

Investing early—and often: Corporate venture investment by company stage.

Trend #2: Competition with PE firms intensifies

Private equity firms completed a record 4,828 deals totaling $713 billion in 2018, according to Pitchbook. Access to record amounts of capital helped spur the activity, even in light of economic headwinds including changing tax policies and early signs of a potential downturn.

For corporate development teams, the PE threat remains two-fold: As PE firms continue to sit on a lot of dry powder – $1.7 trillion of uncommitted capital as of the end of last year – valuations will likely hold fast or potentially march upward. In addition, PE firms often have more resources and efficient processes for sourcing and evaluating targets, conducting due diligence and quickly completing deals. Corporate development teams can find themselves under resourced and out gunned when they come up against PE deal machines that are completing exponentially more deals each year.

The results aren’t pretty—corporate development teams are now playing catch up to close deals or making offers in already crowded spaces. For instance, we recently witnessed one PE firm identify a target and make an offer before a strategic buyer could even sign the NDA. It’s reactive approach, and it’s not doing corporate development any favors.

PE deals pick up pace – Private equity firms serve up some fierce competition in the M&A space.

Source: Pitchbook U.S. PE Breakdown 2018

Trend #3: A focus on divesting “non-core” assets and reinvesting

Within corporate development teams, acquisitions have long demanded the majority of attention and resources. But thoughtful divestments play just as important of role in improving company performance. Done well, divesting provides the opportunity to reshuffle assets in a way that better aligns with the organization’s core competencies. Divestments also transform underperforming assets into cash, which can then be reinvested into more promising ventures.

The concept isn’t new. However, companies are recently ramping up their divestment activity, as reshuffling assets becomes a regular part of corporate development work. EY, for example, reports that a record 87% of global companies are planning a divestment within the next two years. This is a marked increase from 43% in 2017. Of those executives surveyed in the report, 73% say the changing technology landscape is spurring their divestment decisions. Half report that they plan to use the proceeds of the sale to invest in new technology.

Yet, even as leadership becomes more comfortable with divesting, the work can be difficult to do in-house. The internal incentive structure is typically set up to reward building and growing companies, and there are few processes in place for selling assets. An outsourced firm can spearhead the effort, and allow the corporate development team to devote its time toward acquisitions that drive the company forward.

Why divest? Executives cited the reason for their most recent divestment.

Source: EY Divestment Report, 2018

Make your corporate development team more agile—and successful

You don’t need a giant corporate development team to win deals and streamline acquisition integrations. But you do need to reimagine your approach, with an eye toward building processes and cultivating resources that allow to you scale up quickly when opportunities arise.

Consider these 4 tips for increasing the competitiveness of your corporate development team:

1. Set your corporate development vision.

Corporate development teams are often balancing multiple directives and deliverables at once. So perhaps it’s not surprising that many find themselves responding to situations, instead of proactively planning their best course of action. The trouble is that once you’re in a reactive mode, you’re already behind. You’re bidding on companies that are for sale in the market versus finding opportunities before others, and you’re paying prices that reflect that. In addition, the technology advantages provided by these known quantities have already been broadly publicized, including to your competitors, reducing their value before you even put the tech to use.

In this ultra-competitive corporate development environment, taking the time to re-imagine and then set direction at least once every two years is critical. Develop a game plan for what assets you’re looking and for and why. Ask the hard questions:

Be ruthless with your answers and get creative with your solutions. Look at near-term and longer-term strategies. For example, if you’re not seeing viable tech targets that make sense from an acquisition standpoint, then perhaps your next act is creating a corporate venture fund. This way you can simultaneously seed the next generation of technology that your industry demands, while still making acquisitions when they make sense.

This is the point where outside help is especially valuable. The right advisory firm will provide an honest assessment of your organization, and develop a plan that includes transformative targets or add-on opportunities that you hadn’t considered. In addition, having a deep understanding of your ideal acquisition, how M&A serves larger company goals and what synergies you offer an acquired company ensure that you can make decisions more quickly and better compete in the market.

We recently had a client that showcased how this can work. A wealth tech company engaged us to determine how M&A could help fill in some of their customer and competitive gaps. We identified a heat map of the landscape solutions and prioritized five niche markets they should pursue. We were then able to quickly uncover a few ideal targets—and within less than a year, helped them acquire a Canadian technology shop. Two year later, with the company fully integrated, our client’s business has more than doubled.

2. Mind your M&A brand.

Your organization has a brand associated with its products, a brand that reflects your culture as an employer and an M&A brand. The last impacts how targets see your company as a potential acquirer. Do you have a solid reputation? Did previously acquired founders and executive teams have referenceable experiences? Was the integration successful?

While the notion of an M&A brand may seem somewhat amorphous, any company you’re considering either already has a preconceived notion of your organization as a buyer—or the founders are looking for information about you. The Internet is littered with Medium and blog posts about deals not done and acquisitions gone wrong, narrated by the inside experience of founders and startup employees.

You don’t want to be the topic of one of these posts, and paying attention to your M&A brand helps. This work encompasses many things: How you source potential acquisitions, how you approach negotiations, and of course, the success of any integrations. Keep in mind that building a solid M&A reputation is as much about these big ideas as it is about the details. So you need to focus on both.

For example, take a thoughtful approach to connecting with targets. A generic email blast with the wrong name of the contact at the top doesn’t engender a lot of confidence from a potential acquisition. Sending personalized communication to only select companies, clearly articulating why you’re interested and citing specific benefits to both parties sets you apart from competing suitors.

3. Develop an integration playbook.

Strategic buyers and sellers typically embark on an acquisition with a lot of optimism. But the harsh reality is that roughly half of acquisitions underperform. A big reason: companies pour a lot of effort into the deal, and much less into the integration. They don’t contemplate how they can make the acquired company even better—and there’s little process for bringing the smaller company seamlessly into the larger organization.

Creating an integration playbook changes the game, building steps and processes for everything from employee onboarding to customer communication. While each corporate development team will have their own playbook, the integration plan should address:

A playbook isn’t a one-and-done corporate exercise. It’s a living document that provides a repeatable, scalable process you implement with every acquisition. And as a result, the integration process becomes easier, more efficient and more meaningful to everyone involved.

4. Increase your corporate development bandwidth.

Corporate development teams are masters at prioritizing work. But because they are typically small in number, choosing to focus on deploying corporate venture funds or building out an integration playbook usually means setting something else equally as important aside. You can’t do it all—at least not all at once. This is when outsourcing corporate development projects makes sense.

With outsourcing, you can increase your team’s bandwidth without creating additional fixed costs. An advisory firm can help you develop a repeatable integration plan, facilitate the process of creating a long-term corporate development strategy, implement a corporate venture initiative or build out a pipeline of acquisition targets.

For example, we recently had a client in the leadership development space who wanted to use acquisitions to accelerate their own growth. We identified three buckets of companies in their industry that would do just that—both technologies and services. We then helped them target specific technology companies that were a good cultural fit, as well as launch a corporate venture fund to invest in areas that need more attention. The flexibility of the partnership means they can lean on us when they’re planning a deal or large project, then dial back the spend in the interim.

The corporate development world is as exciting as ever. But with the increased opportunities also comes more competition and higher expectations. Understand the current environment and develop tools and resources to better navigate the challenges. In doing so, you’ll create a proactive corporate development team that’s able to jump on deals, successfully integrate acquisitions and ultimately lay the foundation for a vibrant future for your organization.

Learn more about Harbor View’s CATALYST for Corporate Development